Economics Terms

- Bank of England — the UK’s central bank responsible for lending money (More)

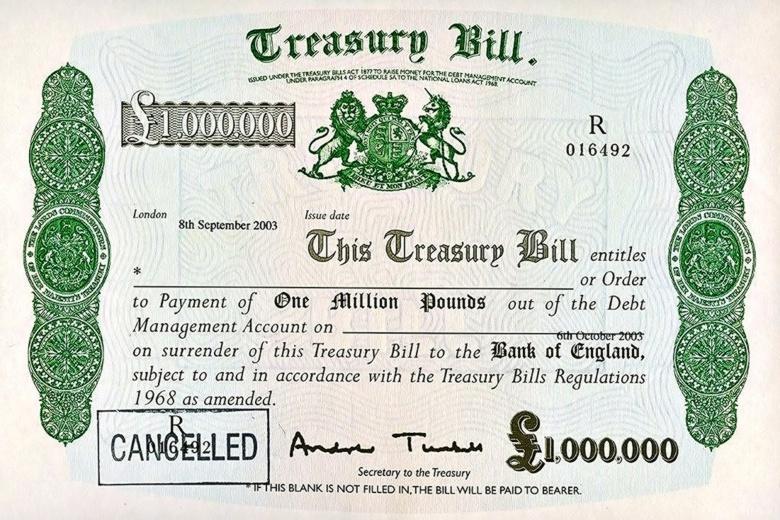

- Bond/Gilt — A loan made to the government that it promises to pay back after a certain length of time, plus a fixed amount of regular interest (typically paid twice a year). It is one way that a government can borrow money. The price of a bond may change depending on the interest rate, and time to maturity (when the government buys back the bond). (More at Investopedia)

- Central bank — The institution that manages a country’s money. It is often named after the country (e.g. Bank of England, Wikipedia). In the U.S. it is called the Federal Reserve (Wikipedia), in the European Union it is called the European Central Bank (Wikipedia).

- Chartalism — a theory that defines money as something created by the government that gets its value from its legal status, and so has no intrinsic value. (ref) See Fiat money and metalism

- Debt — an amount of money owed. The National Debt is the total amount that the Government has spent into the economy, and not taxed back yet.

- Deficit — the difference between the amount of money spent, and that received, typically measured over the course of a year. (More at Investopedia)

- Deflation — The continuous fall in prices. High deflation means prices are falling a lot, low deflation means prices are falling more slowly. The opposite is inflation.

- Economics — is the social science that studies the production, distribution, and consumption of goods and services. It is often split into two main categories: microeconomics and macroeconomics (see below)

- Endogenous money — Money that is created by banks or government without the requirement of having the money in an account as savings. Banks do not lend out other customers’ savings, but literally use computer keystrokes to create a liability and loan account. Likewise the government does not rely on spending “taxpayers” money, the UK Parliament determines spending in the Budget, and instructs the Bank of England to create an account, that may later be removed from the economy with taxes. (See also exogenous money)

- Energy sovereignty — refers to countries that produce, and are self-sufficient in their own energy, without having to rely on another country.

- Exogenous money — The idea that money is derived by banks and government from existing savings, or taxpayers’ money, and assumes that the money supply is fixed. (See also endogenous money)

- Federal Reserve — the central bank of the U.S.A that is responsible for lending money (More)

- Fiat money — money issued by a government that is not backed by a gold or silver. (ref) See also Chartalism and Metalism,

- Fiscal deficit — When a government has spent more into the economy than it has received in taxes. Fiscal deficits stimulate the economy. The total amount over all time is the National Debt.

- Fiscal policy — is the action a government can take to influence the economy, and includes government spending and taxation. See also Monetary policy.

- Fiscal surplus — When a government has spent less into the economy than it has received back in taxes. Fiscal surpluses hinder the economy and may lead to austerity. The total amount over all time is the National Debt.

- Gold standard — money that has a value backed by gold. See also “Gold standard to labour standard“

- GFC — Global Financial Crisis (2007-2008)

- Heterodox — Not orthodox, ie. not conforming to standard or conventional wisdom. e.g. MMT is a heterodox economic theory.

- Inflation — The continuous rise in prices. High inflation means prices are increasing a lot, low inflation means prices are increasing more slowly. The opposite is deflation. It is typically based on the last 12 months.

- Job guarantee — an MMT policy that encourages the government to become the Employer of Last Resort, and guarantee a job to anyone who wants one, at a living wage.

- (ref)

- Macroeconomics — large-scale economics such as that applied to a country. May include factors such as interest rates, national productivity and taxes.

- Metalism — a theory that defines the value of money as derived from the commodity it is based on, such as a gold standard (ref) See Chartalism and Fiat money.

- Microeconomics — studies individuals and business decisions, focusing on supply and demand.

- Modern Money Theory (MMT) — is a description of the way money really works in a country. This suggests some differences from how many people and economists think the economy works.

- Monetary policy — is the action a country’s Central bank can take, to influence the inflation rate, and the amount of money in the economy. Actions include changing the “base” interest rate which affects saving and loans, and buying and selling government bonds (sometimes through quantitative easing (QE). (More) See also “Fiscal policy”.

- Monetary sovereignty — refers to countries that issue and control their own currency. Many European countries do not have monetary sovereignty because the European Central Bank controls their currency, the Euro.

- Money (currency) — the means by which the government officially keeps an account of its finances. This may include currency (notes and coins), and a digital form that is recognised and managed by a money account (ie. bank account)

- NAIRU — “Non-Accelerating Inflation Rate of Unemployment”, a theoretical level of unemployment below which inflation would be expected to rise. It was introduced in 1975 as an improvement over the “natural rate of unemployment” concept. NAIRU suggests that inflation can be controlled through unemployment. It is contested.

- National Debt — is the total amount of money that the Government thinks it owes (to itself?). From an MMT point of view, it is the amount invested in the country, it is your saving, and money in your pocket.

- Neoliberalism — an ideology that uses microeconomics to make the markets “more efficient”, such as: curbing the powers of the unions, reducing job protections, reducing wages and other entitlements, and reducing income support schemes (ref)

- Sovereignty — absolute power and monopoly of the state. For example, monetary sovereignty, energy sovereignty, food sovereignty.

- Tax — the means by which a government drives its currency and gives it value, as it is a statutory and legal requirement. It removes money from the economy, and once paid, it is deleted and no longer available.

- TINA — “There Is No Alternative”, used as a political slogan by Margaret Thatcher in response to critics of her monetary policy.

See also: MMT Economics Jargon Buster (Part 1) (Part 2) (Part 3) (Part 4)